Grow Deposits and Loans While Staying True to Your Mission

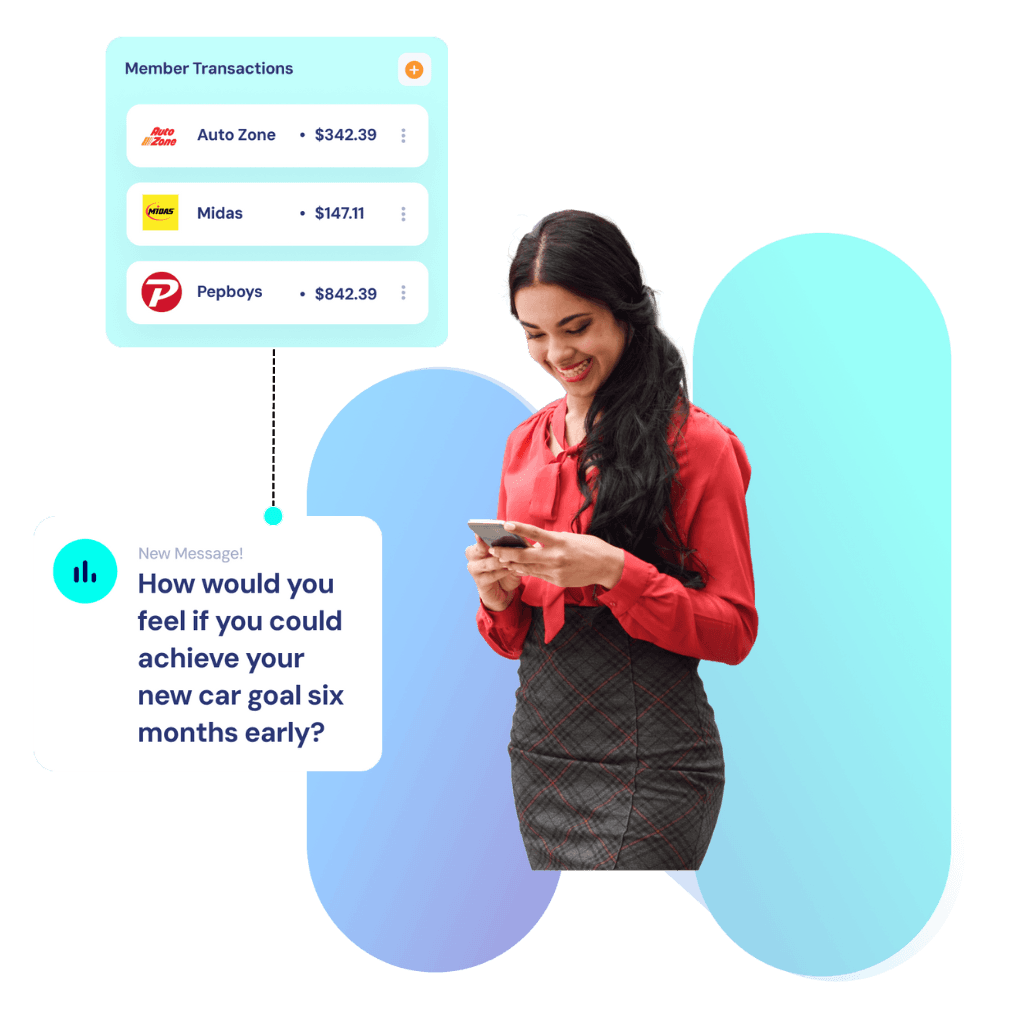

Identify and convert up to $24MM of new shares and loans by delivering personalized financial guidance

Learn More

Built for credit unions with limited marketing and data resources

We Love Our Partners

The Nudge Money team went above and beyond to truly get to know us and our members, listening to our needs and customizing the platform in ways that let us accomplish more than we had ever anticipated. Working with them has been a pleasure—they’ve brought genuine warmth and thoughtfulness to the table, along with their expertise.

Digging deeper into our data with their team has revealed just how much potential we were leaving untapped. Their guidance has empowered us to offer personalized messaging and solutions tailored to each member’s financial goals—something essential for both our growth and our members’ financial well-being.

Shirley Saffold, CEO

WeDevelopment Credit Union

Grow Balances

With hidden opportunities in your existing core data.

Boost Retention

Through personalized outreach to every member.

Improve financial behaviors

By helping members achieve their goals.

What do credit unions think of personalized and relevant advice?

86%

agree that it is a key priority

75%

lack confidence in their ability to personalize

Achieving your credit union’s goals just got easier

Easy To Implement and Use

New partners shouldn’t bog down your team and resources. Get value instantly with little to no effort. We are probably already integrated with your core and other systems. You get the backing of our entire team of expert marketers, behavioral scientists, and software engineers to make your jobs easier.

Safe and Proven

Since we are built specifically for Credit Unions, and as an NCUA compliant company with a team of financial institution executives, you can feel confident that the best practices of your credit union peers are built right in and we are helping you achieve your mission and strategic plan.

Scale Beyond

We are the only solution designed to help Credit Unions grow AND achieve their financial wellness mission. Understanding your members' needs and sending them an impactful message shouldn’t require a big marketing team. We are committed to helping you achieve your strategic plan.

Turn your data into growth and financial wellness in seconds